maine excise tax rate

Individual Income Tax 1040ME Corporate Income Tax 1120ME Estate Tax 706ME Franchise Tax 1120B-ME Fiduciary Income Tax 1041ME Insurance Tax. MAINE OFFICE OF TOURISM.

Ernst Young Finds Oregon Has Nation S Lowest Total Effective Business Tax Rate Oregon Center For Public Policy

The maine state sales tax rate is 55 and the average me sales tax after local surtaxes.

. 6 year 0040 mil rate If a town did not collect excise tax then. Watercraft Excise Tax Requirement. 18 rows Commercial Forestry Excise Tax.

7 on-premise sales tax. 1800 per 31-gallon barrel or 005 per 12-oz can. The Maine State Statutes regarding excise tax can be found in Title 36 Section 1482.

Watercraft Excise Tax Rate Table. The Maine state sales tax rate is 55 and the average ME sales tax after local surtaxes is 55. To calculate your estimated registration.

Maine Cigarette Tax - 200 pack. Exact tax amount may vary for different items. In Maine cigarettes are subject to a state excise tax of 200 per pack of 20.

This calculator is for the renewal registrations of passenger vehicles only. DYER LIBRARY SACO MUSEUM. The rates drop back on january 1st each year.

How much will it cost to renew my. 107 - 340 per gallon or 021 - 067 per 750ml bottle. Departments Treasury Motor Vehicles Excise Tax Calculator.

Contact 207283-3303 with any questions regarding the excise tax calculator. Federal excise tax rates on beer wine and liquor are as follows. As of August 2014 mil rates are as follows.

Maine Watercraft Excise Tax Law - Title 36 Chapter 112. Multiply your vehicles msrp by the appropriate mil rate. Visit the Maine Revenue Service page for updated mil rates.

Cultivators will pay a 335 per. Designed to provide the public with answers to some of the. - NO COMMA For.

The tax rate is 25 for every 1000 of your vehicles value. The price of all motor fuel sold in Maine also includes Federal motor fuel excise taxes which are collected from the manufacturer by the IRS and are used to. 16 rows Effective July 1 2009 the full diesel excise tax rate is imposed on biodiesel fuels that contain less than 90 biodiesel fuel by volume.

The rates drop back on January 1st each year. Monday-Friday 8AM to 5PM. Maine imposes excise taxes on various forms of marijuana being transferred between licensees in the state such as cultivators dispensaries and wholesalers.

Excise Tax Calculator This calculator will allow you to estimate the amount of excise tax you will pay on your vehicle. Mil rate is the rate used to calculate excise tax. 2022 Maine state sales tax.

The excise tax due will be 61080. Watercraft Excise Tax Payment Form - 2022. YEAR 1 0240 mil rate YEAR 2.

Enter your vehicle cost. Share this Page How much will it cost to renew my registration. Spinney Creek Tide Gate Schedule - 2022.

Cigarettes are also subject to Maine sales tax of approximately 035 per pack. Federal Fuel Excise Taxes. 1 City Hall Plaza Ellsworth ME 04605.

Town of Eliot 1333 State Road Eliot Maine 03903 207 439-1813. WATERCRAFT EXCISE TAX RATES Commercial Tax 300 300 Tax 300 Tax 350 Tax 500 650 1000 Tax 550 700 1050 Tax 650 800 1150 Tax 750 900 1250 Tax 900 1050 1400 Tax. 4 The fuel excise tax rates in effect on July 1.

How much is excise tax in. A registration fee of 3500 and an agent fee of 600 for new vehicles will also be charged for a total of 64180 due to register your new vehicle. Excise Tax is calculated by multiplying the MSRP by the mil rate as shown below.

2721 - 2726.

Tax Talk And Why It Might Be Misleading Our Votes

Excise Tax Information Cumberland Me

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Maine Reaches Tax Fairness Milestone Itep

Upsssc Cane Supervisor Result 2019 Languages Questions Supervisor Merit

Maine S Tax Burden Is One Of The Highest New Study Says Mainebiz Biz

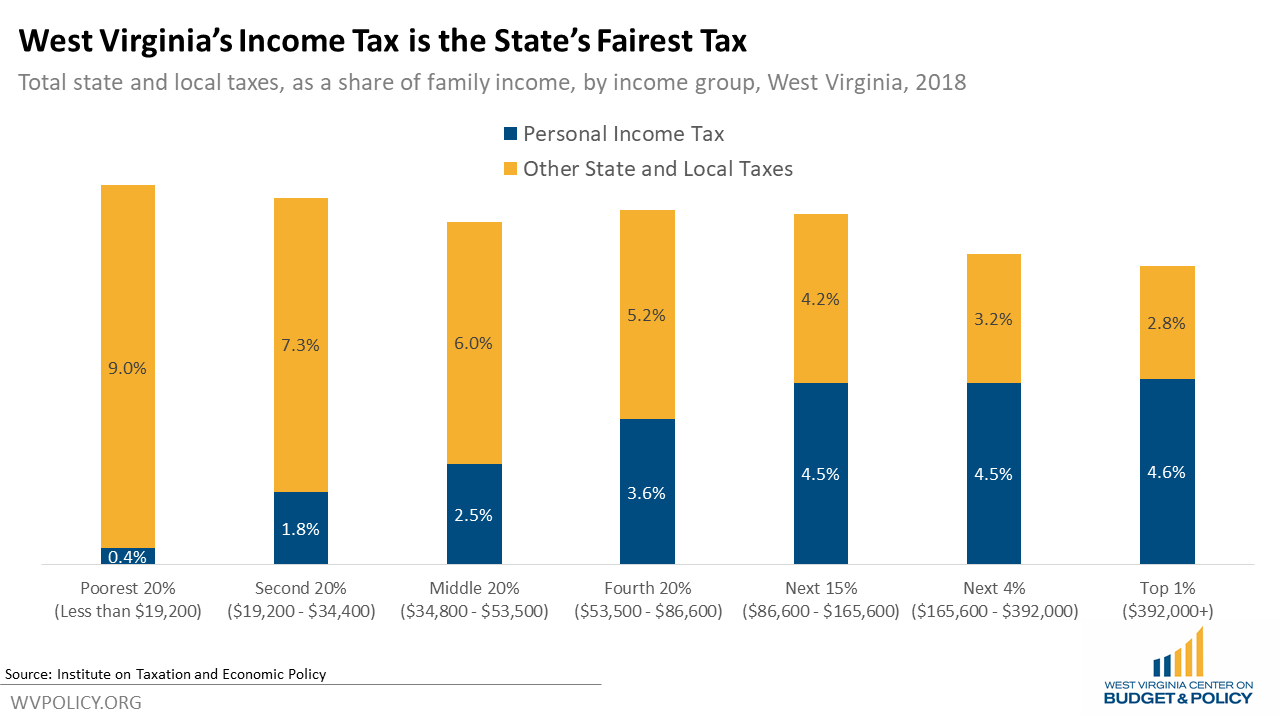

Eliminating The Income Tax Benefits The Wealthy While Undermining Important Public Investments West Virginia Center On Budget Policy

States With Highest And Lowest Sales Tax Rates

Ultimate Excise Tax Guide Definition Examples State Vs Federal

Cigarette Excise Taxes In Select States Per Pack Infographic Http On Wsj Com K81nby Infographic The Selection Tax

Excise Tax What It Is How It S Calculated

2022 State Income Tax Rankings Tax Foundation

Maine Sales Tax Small Business Guide Truic

State Alcohol Excise Tax Rates Tax Policy Center

Georgia Tax Forms 2019 Printable State Ga Form 500 And Ga Form 500 Instructions Tax Forms Tax Return Estimated Tax Payments

Maine Who Pays 6th Edition Itep